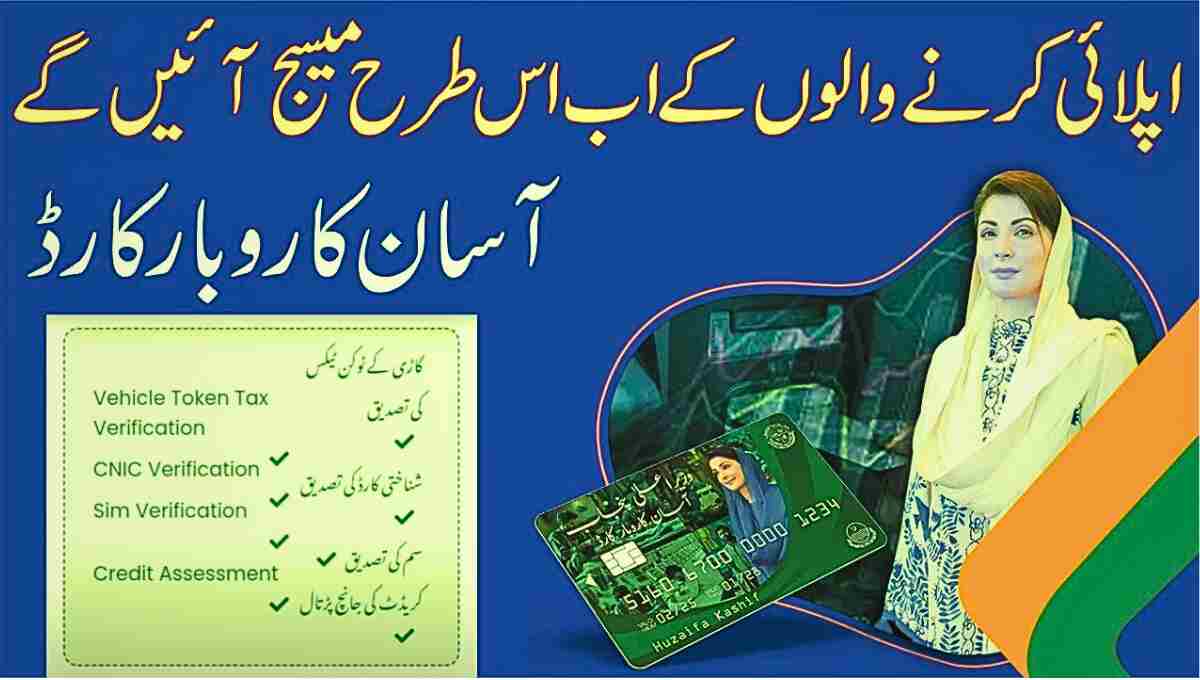

In todays article we will discussed the latest updates of Asaan karobar loan scheme. Nowadays, How we can Eligible for 1 lac to 1 million rupees loan through the Govt scheme named by Asaan karobar loan scheme.

Applicants are now receiving messages in a particular way. If the ticks on your verification turn green, then you are surely eligible for asaan karobar loan scheme and also receive an amount up to 1 million rupees either to start a new business or to support your existing business.

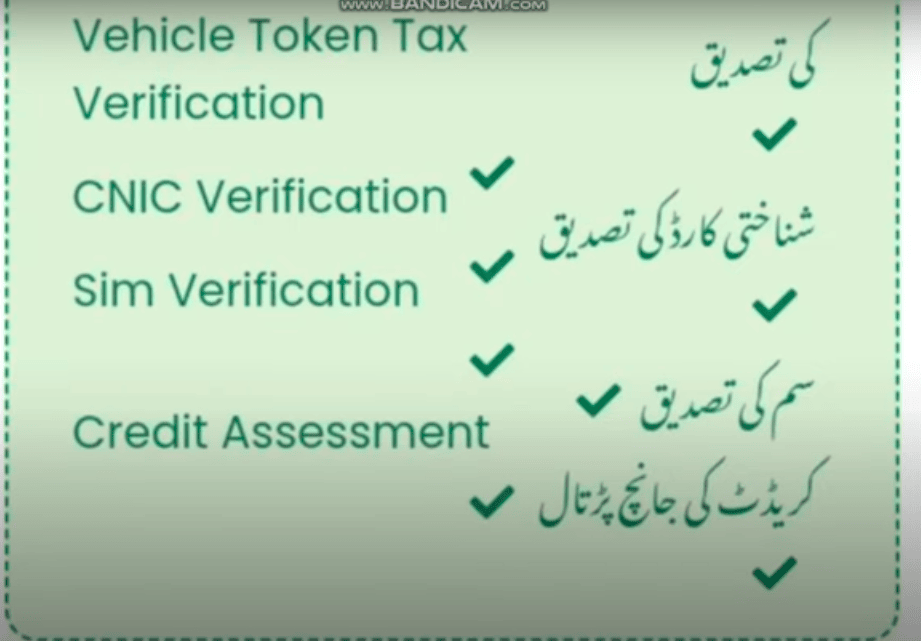

Important Verification Checklist of Asaan Karobar Loan Scheme

We’ll explain the details—verification of vehicle token and tax payment, ID card authentication, SIM verification, and credit Assessment. If you want to check all your verifications before applying, like vehicle tokens, ID card, SIM, and credit Assessment, make sure everything is in order before applying. This increases your chances of easy application approval.

1. Vehicle Token and Tax Verification

- Whether it’s a motorcycle or a car, all tax payments must be cleared.

- Visit the Excise Office for verification.

Let’s explain further—if you’re receiving any errors or want full information, keep in mind: whether you ride a motorcycle or drive a car, your token and tax verification must be clear. If you’ve already paid your vehicle or motorcycle taxes, verify them beforehand. Make sure no dues are pending before applying.

2. National Identity Card (CNIC)

- Your CNIC must be valid (check expiry date and date of birth).

- If you’re married, ensure your Family Registration Certificate (FRC) is updated.

- Verification from NADRA is essential.

Regarding ID card verification: some people face issues because their ID card is expired, their date of birth doesn’t match, or after marriage they haven’t updated their family registration number. These issues result in failed ID verification.

3. SIM Card Verification

- The SIM card you use must be registered under the same CNIC you’re applying with.

- If the SIM is under someone else’s name or the network was changed, it may cause verification issues.

The SIM card should be registered under the same CNIC (ID card) with which you’re applying. The number must be in your own name and should not have a changed network. Make sure this is properly verified.

4. Credit/Mobile Loan Check

- If you’ve taken any loans from banks or mobile apps like Easypaisa or JazzCash, ensure they’re fully paid off.

- Any pending dues may result in your application being rejected.

Credit card/loan verification: Some people have pending loans either from banks or mobile loan apps like EasyPaisa or JazzCash. Make sure no loan is outstanding. If you have any pending, your application won’t be assessed and will likely be rejected.

Also, be aware that if there’s any objection or cross mark on your verification, your application might face difficulties and delays in receiving funds. Today’s Article will guide you on how to ensure your details get green-tick verification, along with updated methods to apply for starting or supporting a business. You’ll also learn how to properly fill out the updated application form.

Before applying, ensure all your verifications—vehicle token, ID card, SIM, and credit card—are green-checked. If you want to know how to check these, You have to know How to Apply for Asaan karobar loan scheme.

Common Mistakes to Avoid

- Also, many people apply without checking their ID card’s expiry date or ensuring their date of birth is accurate. If you apply with incorrect or incomplete info, the government database flags errors, and your application gets rejected.

- When filling the online form, many enter the date first, then month, and then year, which causes verification errors. Make sure your format matches what’s on your CNIC. Wrong date input leads to verification failure.

- Another common issue: SIM not registered under your name—maybe it’s in your brother’s, mother’s, or friend’s name. This too causes verification failure.

- Ensure your CNIC is valid, your phone number is under your own name, and all your tax records are cleared. No pending vehicle tokens or unpaid taxes should exist.

- When registering, some applicants falsely increase their education level, which leads to system rejections. Or they falsely claim to already have a business running, while the system checks their background and finds otherwise.

- If you’re starting a new business, give an accurate location. Don’t write incorrect addresses or assumptions, as that also raises objections.

- Also, don’t apply for a 10 lakh loan if your business only requires 3 or 4 lakh—this mismatch triggers rejections. Apply realistically based on your business need.

Once all verifications are complete—vehicle token, CNIC, SIM, and credit—you may proceed with your application.

What to Do If You Face a Verification Error?

If you encounter any errors:

- Visit the Excise Office for vehicle/token verification.

- Visit the NADRA Office for ID card errors like expiry or incorrect birth info.

- Get your SIM registered to your own CNIC and ensure it’s not converted from another network.

- Clear any pending credit card loans or mobile app loans from banks or foundations.

Conclusion

The Asaan Karobar Loan Scheme is a effective initiative via way of the government to assist folks who need to start or enlarge their agencies. With loan quantities starting from PKR a 1 lac to one million, it opens doors to limitless opportunities for entrepreneurs across the u

However, a success approval relies upon on how cautiously and appropriately you complete your verification process—from your CNIC, SIM registration, tax information, and credit rating exams. By averting not unusual errors and making sure all statistics are updated, you considerably increase your opportunities of being eligible for the loan.

If you follow the checklist and preserve your documents so as, you’ll flow into one step in the direction of securing economic assist and constructing your dream commercial company.

Frequently Asked Questions (FAQ)

1. Who is eligible for the Asaan Karobar Loan Scheme?

Anyone with a valid CNIC, clear credit record, tax-compliant vehicle, and SIM registered under their name is eligible. Both new and existing business owners can apply.

2. How much loan can I apply for?

You can apply for a loan between PKR 100,000 and PKR 1,000,000, based on your business requirements and verification status.

3. Can I apply if I don’t have an existing business?

Yes, you can. If you’re planning to start a new business, you must clearly provide the business details, expected location, and justify the loan amount.

4. How will I know if I’m eligible?

Once you complete your verifications, your application system will show green check marks (✓). That indicates you’re eligible and can proceed with the loan application.